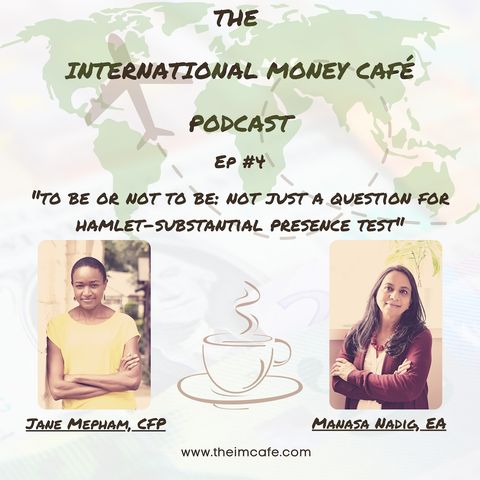

E4: To Be or Not to Be – Not Just a Question for Hamlet (Substantial Presence Test)

Download and listen anywhere

Download your favorite episodes and enjoy them, wherever you are! Sign up or log in now to access offline listening.

Description

In this episode of the International Money Café Podcast your co-hosts Jane Mepham CFP® and Manasa Nadig, EA explain exactly what you need to do to be considered a US...

show moreIf you are a US citizen or a green card holder (permanent resident), by default, you are a US tax resident. If you don’t meet one of those conditions, the IRS has a cool test called the Substantial Presence Test (SBT) that determines how you should be treated for tax purposes.

The test consists of counting the days you have lived in the US over a certain period.

Listen in as Manasa explains the test, including examples, to learn what the Substantial Presence Test is, how it’s used to determine your tax residency, and why it's so important.

For more info about the podcast and your hosts - check out this link.

https://www.theimcafe.com/

The views and opinions are those of the speakers, and should not be considered financial, tax, or legal advice. Consult your advisor for any legal, cross-border tax, and financial advice.

Information

| Author | The International Money Cafe |

| Organization | MANASA NADIG |

| Website | - |

| Tags |

Copyright 2024 - Spreaker Inc. an iHeartMedia Company