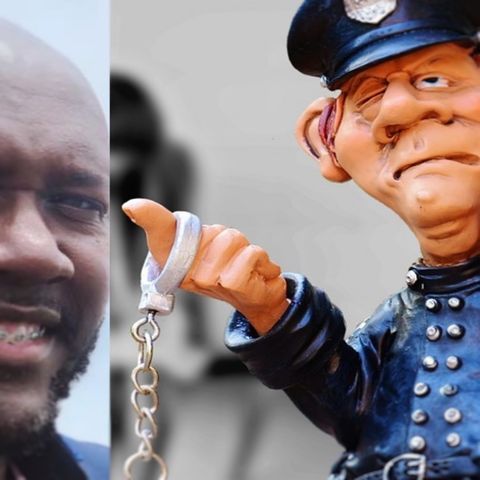

South Georgia pastor indicted on COVID-19 relief fraud charges

Download and listen anywhere

Download your favorite episodes and enjoy them, wherever you are! Sign up or log in now to access offline listening.

Description

A South Georgia pastor, mortician, restaurateur, and tax preparer has been indicted on COVID-19 recovery assistance fraud by a federal grand jury in the Southern District of Georgia. Mack Devon...

show moreMack Devon Knight, 45, of Kingsland, Ga., is charged in a five-count indictment that accuses Knight of lying to the Small Business Administration (SBA) in connection with applications for Economic Injury Disaster Loans (EIDLs), according to David H. Estes, Acting U.S. Attorney for the Southern District of Georgia. The charges carry a statutory penalty upon conviction of up to 30 years in prison, along with substantial financial penalties, followed by a period of supervised release.

There is no parole in the federal system.

“Funding from the Coronavirus Aid, Relief and Security (CARES) Act was provided to help small businesses survive pandemic-related losses,” said Acting U.S. Attorney Estes. “In coordination with our law enforcement partners, we will hold accountable those unscrupulous actors who attempt to swindle these funds for their own enrichment.”

As described in the indictment, in February and March 2021, Knight applied for EIDLs on behalf of two Camden County, Ga., businesses: Knight’s Tax Services, and Daddy Earl’s Kitchen. Those EIDL applications falsely affirmed that the businesses each had hundreds of thousands of dollars of gross revenue prior to the COVID-19 pandemic. The indictment alleges that Knight then made and transmitted to the SBA a falsified bank document to deceive the SBA into approving one of Knight’s EIDL applications.

The indictment further alleges that, after receiving $149,900 from the SBA as a result of false and fraudulent representations in Knight’s loan application on behalf of Knight’s Tax Services, Knight used part of the funds to buy a Mercedes-Benz S-Class sedan.

Information

| Author | Infographics Daily News |

| Organization | Fadaka Studios - Web Radio. |

| Website | - |

| Tags |

Copyright 2024 - Spreaker Inc. an iHeartMedia Company

Comments